Public Adjuster

INSURANCE CLAIMS ARE COMPLEX.

WE MAKE THEM WORK IN YOUR FAVOR!

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

WHAT IS A PUBLIC ADJUSTER?

PUBLIC ADJUSTER

REPRESENTS THE POLICYHOLDER

INSURANCE ADJUSTER

REPRESENTS THE INSURANCE COMPANY

Conducts a full inspection, documents every structural and contents loss, prepares the claim package, and negotiates on your behalf for the most accurate settlement.

Evaluates the loss on behalf of the insurance carrier and determines what the company believes should be covered.

We only get paid when you get paid — our fee is a percentage of your final settlement.

Paid by the insurance company to manage its financial exposure.

Trained according to the insurance company’s internal standards and guidelines.

Works for the insurance carrier and helps manage the claim according to company policy and cost controls.

We work exclusively for you — ensuring your damage is fully documented, your rights are protected, and your settlement reflects the true scope of your loss.

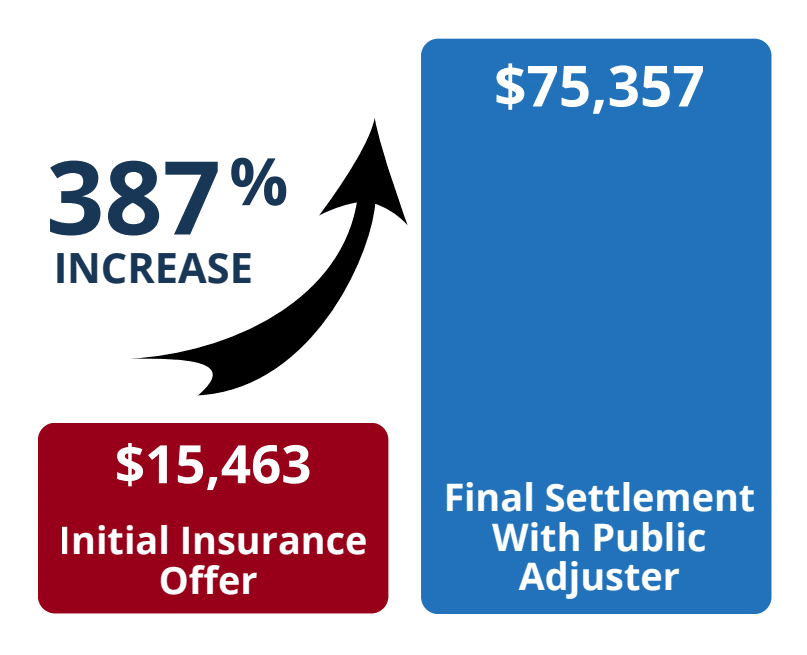

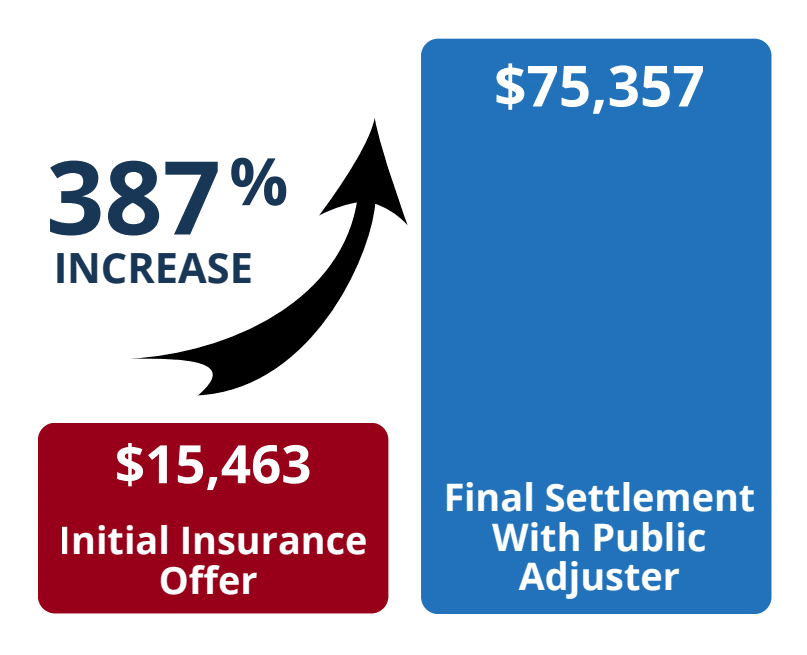

HOW A PUBLIC ADJUSTER CAN INCREASE YOUR SETTLEMENT

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

Donec molestie leo vitae quam tincidunt maximus. Integer quis luctus enim. Curabitur placerat nunc nunc, vitae vehicula libero viverra id. Proin dignissim mi a luctus pulvinar. Aliquam maximus lectus ligula, sed luctus urna faucibus a. Nullam vitae sem quis erat pretium facilisis at at nibh. Ut molestie ex vel nisi finibus porttitor. Pellentesque at augue ligula. Praesent blandit et est sit amet venenatis. Proin in vulputate urna. Donec tristique auctor ipsum, viverra consectetur erat mattis in. Aenean efficitur odio eget malesuada blandit. Orci varius natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus.

IF YOU’RE DEALING WITH PROPERTY DAMAGE,

ASK YOURSELF:

- Did the insurance offer seem too low?

- Did they try to patch instead of replace?

- Did they blame “wear and tear,” “maintenance,” or “pre-existing damage”?

- Did they send a preferred vendor who works for them — not you?

- Are they cleaning vs replacing?

OUR PROCESS

Contact us for a FREE claim review

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Negotiate the Claim

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Understand Your Coverage

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Challenge the Offer

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Document the Full Damage

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Get Paid Fairly

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Questions about your property damage? We’ve got answers.

EXTENDED COVERAGE YOU MAY HAVE

Many policies include additional coverage beyond the stated limits — often 10–50% more — but most homeowners aren’t aware of it.

YOUR POLICY MAY ALSO INCLUDE:

- Extended Replacement Cost: An additional 10 to 50% ABOVE your policy limit for structural replacement

- Mold Remediation: An extra $5,000 for mold cleanup

- Code Upgrades: An additional 10% of the policy limit for plumbing, electrical, HVAC, and insulation

- Debris Removal: An additional 5% of the policy limit for demolition costs

These coverages are written into your policy, but they’re often overlooked.

POPULAR INSURANCE CLAIM TYPES WE HANDLE

Fire Damage

We represent homeowners and businesses after fire losses, documenting structural, contents, smoke, and heat damage to pursue the full settlement you’re owed.

Flood Damage

We assist with flood-related losses by documenting structural and contents damage and coordinating coverage considerations where applicable.

Storm Damage

We handle wind, hail, and severe weather claims by documenting roof, exterior, and interior damage often underestimated by insurers.

Theft & Vandalism

We help property owners recover losses from break-ins, vandalism, and malicious damage by fully documenting stolen or destroyed property.

Water Damage

From burst pipes to appliance leaks, we evaluate sudden water damage, identify hidden impacts, and challenge underpaid or disputed claims.

Building Collapse

When structural failure occurs, we assess visible and hidden damage, coordinate expert evaluations, and pursue proper coverage for repair or rebuilding.

These are some of the most common claims we handle.

We also represent clients in additional claim types — visit the Claim Types section in our site menu to learn more

TRUSTED BY HOMEOWNERS. CHOSEN BY BUSINESSES.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

Frequently Asked Questions

Dealing with an insurance claim? Here’s what our clients ask most often!

The most common are Illinois water damage and fire incidents. But that’s not all. The most common are Illinois water damage and fire incidents. But that’s far from all. In particular, we handle damage caused by severe weather: cracks from extreme cold or roof punctures from hail. We are licensed independent adjusters with experience handling all these types of claims.

Before you even contact the insurance company. The earlier we get involved, the more accurately damages for loss of use of property and repair are documented, and the less chance there is that the insurer will miss or undervalue anything. We document everything correctly because our goal is to maximize your payout.

Yes. We both file claims and handle fire and water damage restoration: foundation repair, roof replacement, and fire damage cleanup. You don’t need to search for contractors – we do everything turnkey.

No, we handle everything. If you have photos of the damage, documents from your insurer, or a copy of your policy, it can help speed up the process. But even without these, our adjusters on demand will begin work.

Yes. We handle commercial claims for businesses, offices, warehouses, and retail spaces, including business interruption insurance claims if the damage resulted in lost income.

Yes. We can review your case, make corrections, submit additional documents, or challenge underpayment. Even if the process has already started, it’s not too late to involve our accredited claims adjuster.

TRUSTED BY HOMEOWNERS. CHOSEN BY BUSINESSES.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut pulvinar felis ac est elementum vulputate. Proin facilisis vehicula nulla, sed feugiat eros egestas in. Integer bibendum rutrum placerat. Integer iaculis condimentum sodales. Maecenas ac rhoncus ex, nec aliquam eros. Vivamus vitae dictum tellus. Ut tempus vel eros sed feugiat. Quisque sagittis a lectus vitae eleifend. Donec aliquet aliquet dolor sit amet consequat.

Illinois Public Adjuster Agency License #3000872396

IL License No: 16960983

WI License No: 16960983

CA License No: 4388919

CA License No: 6012768

READY TO GET YOUR PROPERTY BACK TO NORMAL?

Fill in this form, and we'll get back to you shortly

Insurance companies don’t usually deny fire damage claims outright — they minimize them 🤔

They make serious damage sound “minor,” call structural issues “non-structural,” or approve just enough to get you started… but not enough to finish.

☝️That’s not an accident. That’s a lowball strategy.

Our job at On-Site Adjusting is to uncover the real impact of the fire, show the evidence insurers avoid, and push for the full payout needed to restore your home safely.

🔥 If your fire damage claim feels “too low,” trust your gut. Reach out to us for a free consultation

...

When the insurer offers quick patches instead of replacing 🥲

Has your claim ever been patched instead of properly fixed?

...

What Happens When a Public Adjuster Re-Evaluates Your Fire Damage Claim 😉

This commercial storage facility in Rockford, IL was originally valued at $400K — barely half of what was needed to rebuild.

We stepped in, inspected the full site, documented every impact, and proved the true scope of damage.

Result? Policy limit paid out: $811,103.

Every dollar available — secured for our client 👌

Whether you own a storage facility, retail space, warehouse, or rental units… insurance shouldn’t get the final word on your losses.

🧐 Think your claim is undervalued? Let us take a look.

DM us or call (866) 861-4992 for a free consultation!

...

The reality of life when it comes to property damage 🫠 ...

Most homeowners don’t realize how much insurance company language affects their payout 🤯

A simple water-damage report can turn into delays, confusion, or a lower offer — not because you’re not covered, but because the wording makes you think you aren’t.

That’s where a public adjuster makes the difference.

We explain the process clearly, gather the right documentation, and make sure your claim reflects what actually happened — not what it’s labeled as.

💧 If you’re dealing with water damage, we can help. Reach out to us for a FREE claim review

...

Another homeowner protected 🤝

Another claim handled the right way.

Whether it’s water damage, fire loss, storm impact, or structural issues, we step in when your insurer falls short.

Thank you to our clients for trusting On-Site Adjusting when it matters most! 🙌

...

When property damage looks impossible — it usually just means the insurer hasn’t looked close enough.

👀 Every claim has fine print.

🔍 Every “denial” has a loophole.

You just need someone who knows where to find it.

💬 Have a claim or denial? Let’s review it for free — 866-861-4992

...

Sometimes it takes one small detail to turn “denied” into “paid.”

That’s why we dig deeper. Every time.

💧 Water damage doesn’t wait!

👉 Free claim review — 866-861-4992

☑️ We’re licensed public adjusters in IL, WI and CA

...