When your property is damaged by fire, flooding, or another incident, the first thing you do is file an insurance claim. But instead of the expected payout, you receive a request for a Proof of Loss. Most policyholders get confused at this point: what is this document, what is it for, and how do you fill it out?

In this article, we get answers to these questions from licensed public adjusters at On-Site Adjusting.

What Is a Proof of Loss Form?

A Proof of Loss is an official, notarized form that a policyholder submits to the insurance company. It specifies the amount of loss, a description of the damaged property, the date and cause of the incident, and other details.

Essentially, this document legally confirms the loss. It is required so the insurer can verify the validity of your claim. Without a Proof of Loss, the claim adjuster has no basis to pursue a payout.

Typically, insurance companies allow 30–60 days to submit a Proof of Loss after it is requested. Failing to meet the deadline may result in losing the right to compensation.

A Historical Note: How It All Started

The Proof of Loss has a long history dating back to the 16th century. At that time, when telephones and email did not exist, documents were delivered to insurance companies by horseback couriers. This was mostly related to royal family correspondence, but it set a precedent.

In medieval Europe, insurance for various risks – property, commercial, and sometimes maritime – was developing actively. Even then, adjuster companies (though they were not called that yet) required written confirmation of losses to process claims, often to prevent fraud.

For example, in the 1570s in England, a code known as the Booke of Orders of Assurances was created. It regulated insurance procedures and the use of documents detailing property losses.

Although technology has changed, the essence remains: a Proof of Loss must be accurate, complete, and legally protected.

Why the Proof of Loss Form Matters

An incorrectly completed Proof of Loss can lead to financial losses:

- the insurance company may deny the claim;

- the process may be delayed for months;

- the payout amount may be reduced.

Suppose your house suffers fire damage, and you did not indicate that the ventilation systems were clogged with smoke – something not visible to the naked eye – what will happen? Reduced compensation. And if you signed the form without understanding its contents, you could completely lose the right to appeal.

Feeling stuck with your claim? You don’t have to fight alone.

Reach out to us — we will review your claim for free and help you understand your options

Step-by-Step Guide to Completing a Proof of Loss

For the insurance company to process your claim, the Proof of Loss must contain specific information. Without it, an adjuster’s claim may be rejected or delayed. Therefore, you should:

- Provide your contact information, address, and policy number. This allows the claims professional to identify your request.

- Indicate the date and type of loss (storm, water, or fire damage, etc.).

- Describe the circumstances that led to the damage.

- Create a list of damaged property – items, structures, or equipment – indicating their value. This forms the basis for a contents total loss estimate.

In principle, this is the essential information. Next — sign the document, submit it for notarization (if your policy or law requires it), and make a copy before submitting.

Tip! Do not fill out the form in a hurry. If you are unsure about anything, consult a professional — especially if you are interested in receiving the maximum compensation.

Common Mistakes Policyholders Make

Most policyholders lose compensation not because of lack of coverage, but due to mistakes in the documents. It’s better to be aware of them in advance.

| Mistake | Explanation |

|---|---|

| Missed deadlines | The insurance company has the right to deny payment if the form is submitted late. |

| Inaccurate or estimated amounts | Do not “guess” the value of damaged property. Actual estimates supported by invoices, quotes, and reports are required. |

| Incomplete list of losses | Hidden damage is often overlooked: foundation, electrical systems, plumbing. If not listed, compensation will not fully cover the losses. |

| Lack of supporting documentation | Without photos, receipts, or inspection reports, the insurance company will not recognize the losses. Include everything you have with the Proof of Loss. |

| Signing without understanding | If you sign the form without reviewing it, you agree with everything written in it and will no longer be able to contest it. |

Before submission, the form should be reviewed by a citizens adjuster. This is not unnecessary caution but a way to protect yourself from losses. If even one item is incorrect, the insurance company will certainly take advantage of it.

How Local Public Adjusters Help with Proof of Loss

When requesting a Proof of Loss, the insurance company is looking for weak points in the document. That’s why, as on-demand adjusters, we do not leave our clients alone with the form.

What we do for our clients:

- We review every item on the form to ensure 100% that all necessary information is included and complies with the terms of the insurance policy.

- We create a structure estimate and contents total loss estimate (total loss inventory, pricing, and evaluation).

- We document all damaged items and structures – with photos, prices, technical descriptions, and contractor estimates.

- We handle insurance claim negotiation that is related to the Proof of Loss and challenge low settlement offers.

We are the best home and business public adjusters licensed in California, Illinois, and Wisconsin. This gives us the right to officially represent you and protect your claim under state law.

Real-Life Example

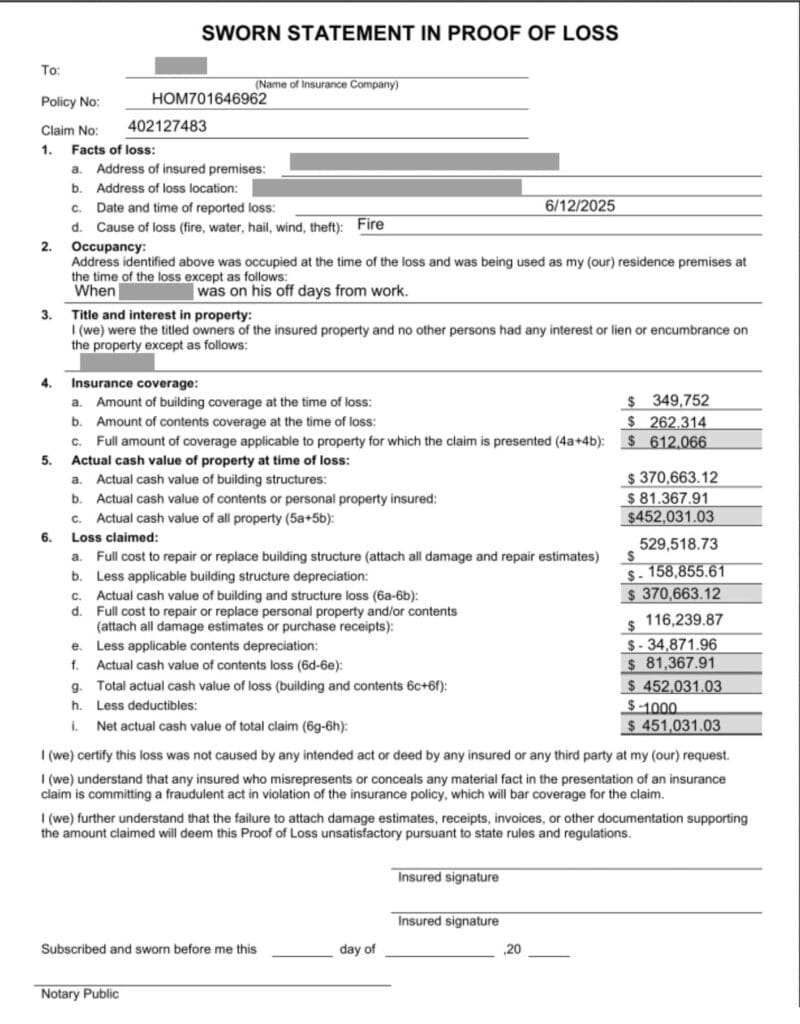

One of our clients faced a house fire. The insurance company requested a Proof of Loss – a complex form with numbers and details.

On their own, they could easily miss something: hidden damage, restoration costs, or property value. We correctly described all losses, added estimates and supporting documents, and guided them through the completion process.

Here’s what the form looked like:

As a result, the client received full compensation because the insurance company could not find any reason to reduce the payout.

Final Thoughts

The Proof of Loss determines whether you receive full compensation or only partial reimbursement. We do not allow insurance companies to dictate terms. If you are unsure where to start – start with us.

Want a free case review? Call the On-Site Adjusting team at (866) 861-4992 or (866) 933-0404, or fill out our contact form.

READY TO GET YOUR PROPERTY BACK TO NORMAL?

Fill in this form, and we'll get back to you shortly