Insurance company claims adjuster will inspect the damage and coldly declare: “This isn’t vandalism. It’s just ‘hard living.’”

Is this distinction critical? Yes, because vandalism is usually covered by your policy, while “hard living” is considered wear-and-tear, which your insurance company will not pay a cent for. This subtle switching of terms is one of the most common tactics used to deny property damage insurance claims.

Don’t want to lose thousands of dollars on repairs that your insurance should cover? Keep reading to learn how to protect your finances by appealing legally and avoid being taken advantage of.

What “Hard Living” Really Means in Insurance Language

For an insurance company, the term “hard living” is a convenient euphemism for tenant negligence or natural wear-and-tear. It refers to damage that accumulates gradually over time due to ordinary (though careless) use of the property.

When a claims examiner writes “hard living” in a report, they mean things that aren’t sudden:

- water rings on wooden floors;

- scratches on drywall from furniture;

- dirty carpets or scuffed walls;

- worn door handles and locks.

Essentially, this isn’t catastrophic damage and is to be expected if the occupants were not very careful.

Feeling stuck with your claim? You don’t have to fight alone.

Reach out to us — we will review your claim for free and help you understand your options

What Counts as Vandalism

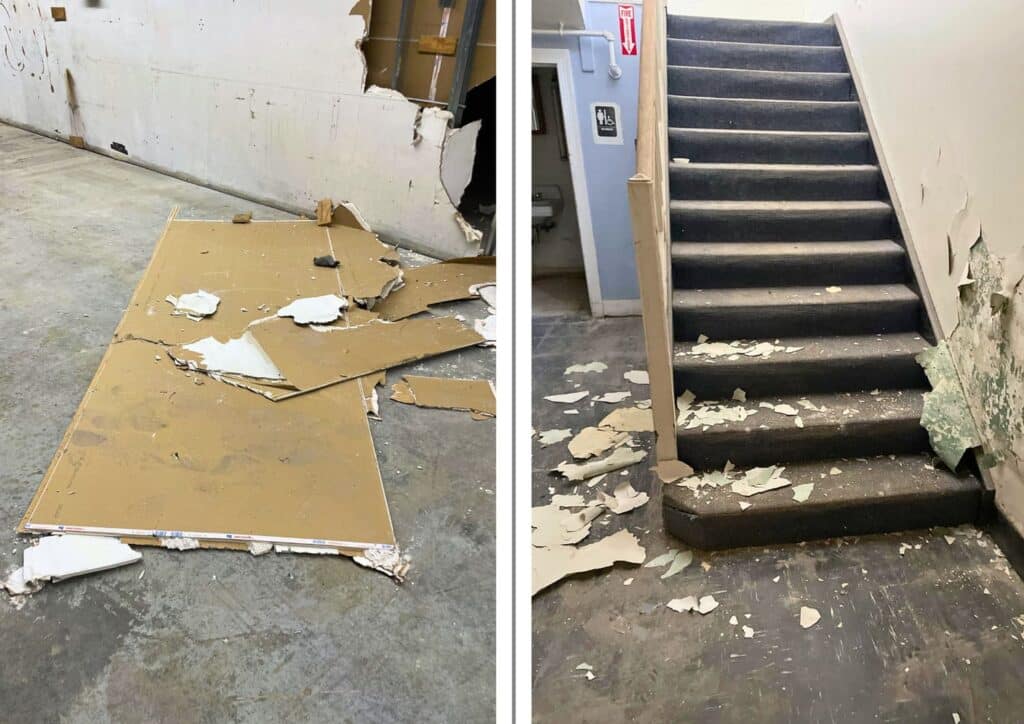

Vandalism is a completely different category. It is deliberate, malicious destruction or damage to property. Your residential or commercial property adjuster should classify a case as vandalism if they see:

- broken or forced doors (signs of forced entry);

- broken windows;

- torn-out copper pipes or wiring (common in vacant properties);

- intentionally turned-on faucets causing flooding (bathroom toilet overflows or blocked drains);

- holes in walls caused by fists or heavy objects;

- graffiti or paint spilled on the floor.

All of these incidents show purposeful action, which distinguishes them from gradual wear-and-tear. If the damage observed could not have occurred naturally during normal use, it is grounds to file a property damage insurance claim under “Vandalism.”

Why Insurance Companies Misclassify Vandalism as “Hard Living”

The answer is simple: money. Calling vandalism “hard living” lets the insurance claims adjuster refuse payment for property damage restoration.

The insurance company’s strategy is to frame the damage as a gradual process. They will claim that the damage did not happen in a single day (as in vandalism) but accumulated over months because the tenant was supposedly careless.

For example, if a tenant smashed a toilet out of anger before moving out, the insurance company will try to write it off as “poor maintenance.” They definitely won’t want to initiate insurance claim negotiation with professional adjusters on demand because they know they would lose.

How to Prove Vandalism (and Not Wear-and-Tear)

To win a dispute with an insurance company, your word alone isn’t enough. An experienced independent property adjuster knows that a successful case relies on documents that disprove the gradual wear-and-tear theory.

Here’s a list of evidence that will make your insurer recognize vandalism:

- Maintenance records: Prove the property was in good condition before the incident.

- Timeline documentation: Recording the date the damage was discovered (for example, saved emails or messages) proves the event was sudden.

- Annual inspection photos: Visual “before and after” comparisons are the best argument against “hard living.”

- Evidence of forced entry: Damaged locks and frames, broken windows — direct proof of intentional action, not wear-and-tear.

- Police reports: Official documentation of the crime (vandalism) carries legal weight.

- Locksmith statements: Professional evaluation clearly documenting broken doors or locks.

- Witness statements (e.g., neighbors): Confirmation of unusual or suspicious activity or noise at a specific time.

The more detailed your property maintenance history is, the harder it will be for the claims loss adjuster to use negligence as an argument.

Documentation Strategy That Wins Vandalism Claims

A winning claim starts long before disaster strikes. Your protection strategy is based on chronology and documenting the condition of your property. We recommend:

- Keep chronological records. Save all work orders and receipts.

- Conduct regular inspections and take photos. Recording your property’s condition every 6–12 months provides proof against a wear-and-tear claim.

- Preserve the scene. If you discover that vandals have struck your property, don’t clean up immediately! First, take hundreds of photos. Your desire to tidy up can destroy critical evidence for your claims professional.

Feeling like your claim was deliberately misclassified as wear-and-tear? It’s time to act. Our public adjusters are ready to step in immediately to challenge unfair tactics and secure the maximum insurance payout you deserve.

How a Public Adjuster Helps You Fight Back

When the insurance company insists on the “hard living” narrative, you need professional protection. With our best public adjuster, restoring fairness is much easier.

- We challenge misclassification, leaving the insurer no room to twist the facts. If a window was broken by force, we prove it’s vandalism, not wear-and-tear.

- We build the evidence. We collect facts of sudden and intentional damage that meet the definition of vandalism in your policy.

- We escalate the case. When an insurance adjuster tries to underpay, we take the negotiation and settlement to management level.

- We reduce the risk of unfair denial, especially in complex situations like a commercial fire insurance claim caused by arson (also a form of vandalism).

Conclusion

Misclassification is so common in the insurance industry that it has become routine. But for you, as a property owner, it can feel like a financial death sentence. Your property is damaged, and the insurance company provides zero help.

But if your property has been vandalized, don’t let the insurance company drain your funds with a denial. Document your losses, preserve evidence, and challenge incorrect insurance adjuster assessments promptly. Or make it simple — let our residential or commercial adjuster handle these tasks for you.

Faced with vandalism but the insurance company says it’s wear-and-tear? Call the On-Site Adjusting team at (866) 861-4992 or (866) 933-0404, or fill out our contact form.

READY TO GET YOUR PROPERTY BACK TO NORMAL?

Fill in this form, and we'll get back to you shortly